Got a letter or notice from the IRS? Here are the next steps

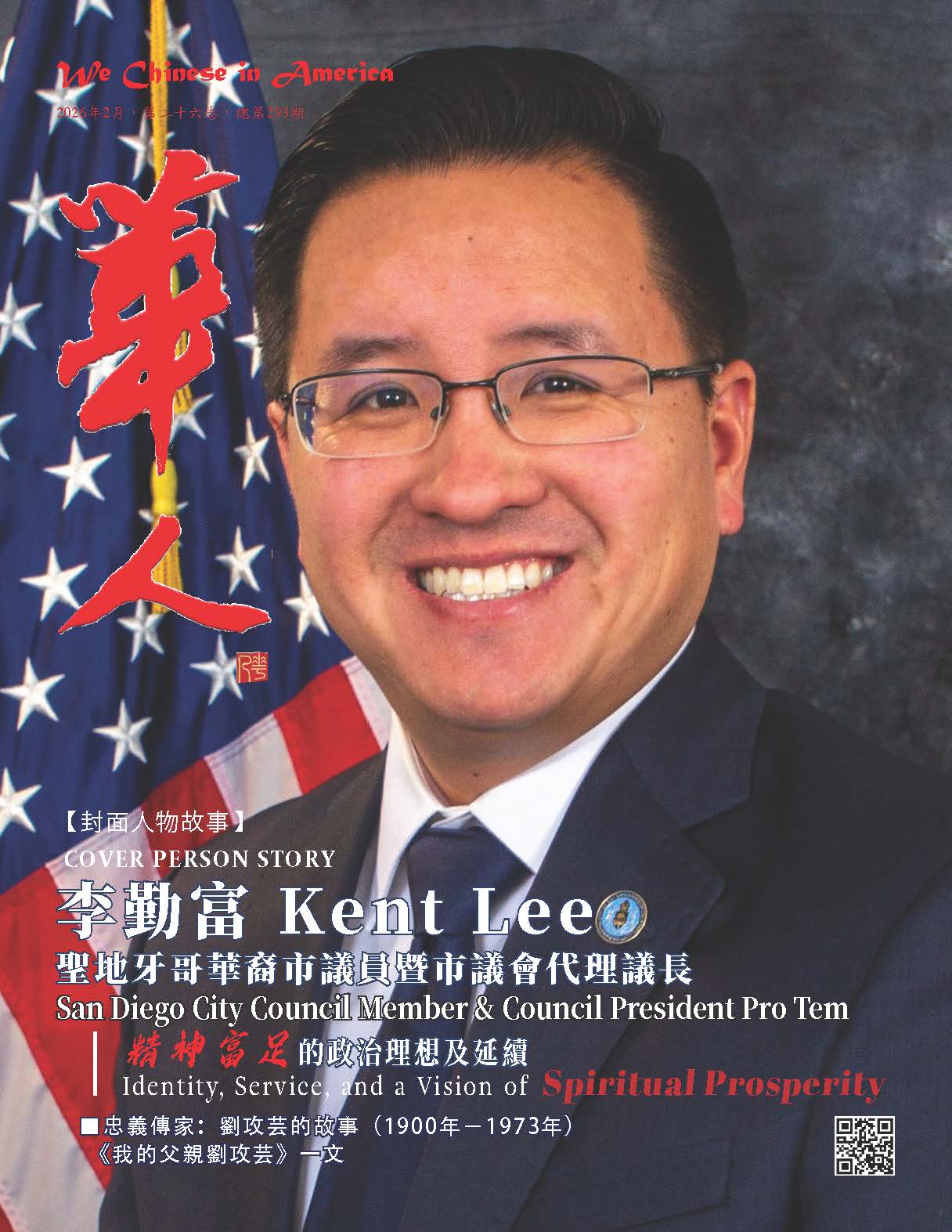

【《We Chinese in America》Media Editor Tang Zhao, September 13, 2022】As a continuous effort to enhance our valuable service to We Chinese in America website readers, We Chinese in America website posts US Army recruitment information directly received from the US Army Recruiting Command headquarter office at Fort Knox, Kentucky. We are pleased to take on this important role partnering with US Army Recruiting Command (USREC) and be a part of the USREC’s Partnership Outreach Program to better inform the public.

Got a letter or notice from the IRS? Here are the next steps

When the IRS needs to ask a question about a taxpayer’s tax return, notify them about a change to their account, or request a payment, the agency often mails a letter or notice to the taxpayer. Getting mail from the IRS is not a cause for panic but, it should not be ignored either.

When an IRS letter or notice arrives in the mail, here’s what taxpayers should do:

Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes specific instructions on what to do. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return. Taking timely action could minimize additional interest and penalty charges.

Review the information. If a letter is about a changed or corrected tax return, the taxpayer should review the information and compare it with the original return. If the taxpayer agrees, they should make notes about the corrections on their personal copy of the tax return and keep it for their records. Typically, a taxpayer will only need to take action or contact the IRS if they don’t agree with the information, if the IRS requested additional information, or if they have a balance due.

Take any requested action, including making a payment. The IRS and authorized private debt collection agencies do send letters by mail. Most of the time, all the taxpayer needs to do is read the letter carefully and take the appropriate action or submit a payment.

Reply only if instructed to do so. Taxpayers don’t need to reply to a notice unless specifically told to do so. There is usually no need to call the IRS. If a taxpayer does need to call the IRS, they should use the number in the upper right-hand corner of the notice and have a copy of their tax return and letter.

Let the IRS know of a disputed notice. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. They should send it to the address on the contact stub included with the notice. The taxpayer should include information and documents for the IRS to review when considering the dispute.

Keep the letter or notice for their records. Taxpayers should keep notices or letters they receive from the IRS. These include adjustment notices when an action is taken on the taxpayer's account. Taxpayers should keep records for three years from the date they filed the tax return.

Watch for scams. The IRS will never contact a taxpayer using social media or text message. The first contact from the IRS usually comes in the mail. Taxpayers who are unsure whether they owe money to the IRS can view their tax account information on IRS.gov.

(Source: IRS Tax Tips)

Internal Resource Service

Media Relation Office

Washington, D. C

Media Contact: 202 317 4000

Public Contact: 800 829 1040

This website has a free subscription function, please enter your email address and name (any nickname) in the upper right corner of the page. After subscribing, you can receive timely updates of the website. I hope that new and old readers will actively subscribe, so that we have the opportunity to provide you with better services

Please click: Home (wechineseus.com) for more news and content on this website

Follow The Chinese Media's Twitter account: https://twitter.com/wechineseinus

Follow The Chinese Media's Facebook account: https://www.facebook.com/wechineseinamerica/