This Year's Tax Return, Many Tax Credits Are Here

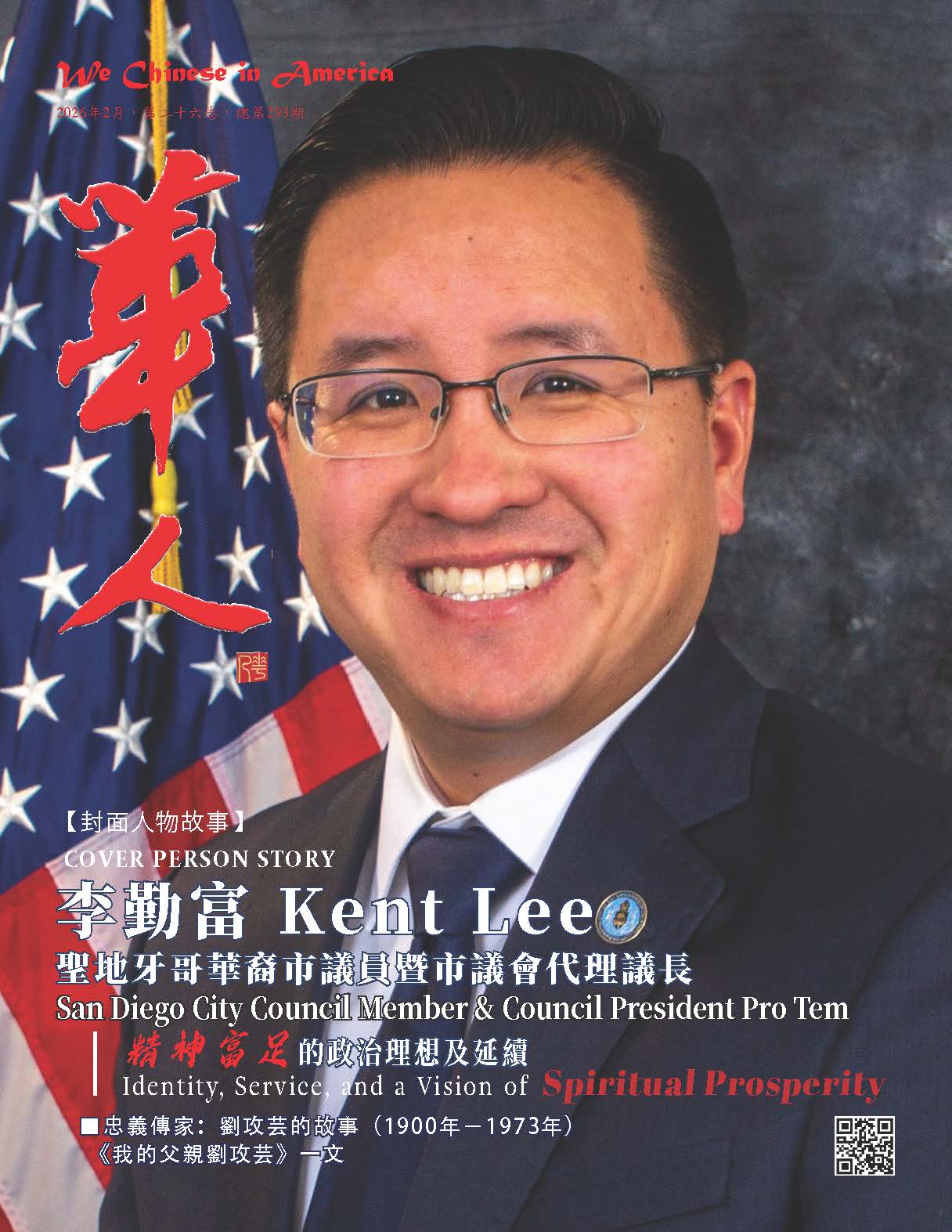

(We Chinese in America Media Editor Tang Zhao, January 31, 2022) Rettig, the 49th head of the IRS, called on the public to file their taxes aggressively. (Screenshot of video conference)

The Minority Media Center held a special meeting on the 28th, inviting IRS officials to speak "2022 tax season - what your audience needs to know about the IRS."

Topics of the day included how taxpayers can file better so they can get their tax refunds as soon as possible, the ability of the IRS's phone service and how to get faster service, how the tax returns that haven't been processed before will affect this year's tax returns, the economy Impact stimulus payments, child tax credit advances, and more.

The 49th head of the IRS, Chuck Rettig, attended the meeting and pointed out that tax filing should not be a matter of anxiety for the public, but an opportunity for eligible people to receive tax benefits and funds. There are many tax incentives, bailouts, and other funds this year, and it is very simple for the public to obtain these incentives, if they file their taxes accurately and immediately.

Chief Taxpayer Experience Officer (Chief Taxpayer Experience Officer) Ken Corbin said that if people file their taxes now, they can get their tax refunds as early as early March and urge everyone to actively file tax returns. He also introduced some tax benefits this year. For example, employees with an annual income of less than $57,414 may be eligible for the Income Tax Credit (EITC). The new rules require that you do not have to be under 65, and you can even apply for certain investment income.

Most of the online tax preparation software is charged, not free. He recommends that the public can use the free tax preparation service (VITA) of the Internal Revenue Service. The public can see the link if they log in to the official website. If you still need help, VITA is also providing volunteers in the community to help with tax returns. If you are worried about meeting offline because of the epidemic, VITA volunteers can also help people file tax returns online, and people can use their mobile phones to make video calls, which is as easy as a video conference that day. That's why he recommends that people install the IRS mobile app, where all these functions can be done.

When asked if the tax filing deadline would be extended this year, the two officials said there was no change to the timeline. They encouraged the public to follow the IRS's social media accounts to get notifications faster and more directly, or to visit the official website to learn more about this year's new policies. The official website is available in various languages for the convenience of multi-ethnic people.

(Source: World Journal)