Danger and Legal Implications When Open a Joint Account with Your Children

(We Chinese in America Media Editor Tang Zhao, March 23, 2022) If parents and children open an account together, once the child withdraws more than 15,000 yuan, that is, the tax-free upper limit of the gift amount (2021), the parents are responsible for filling out the form to declare. Ms. Kim, who works at a mainstream bank, said she was not aware of the rule. However, the accountant pointed out that if the child has never paid in, but withdraws more than $15,000, it will indeed raise the problem of gift tax. .(Danger & Legal Implications Image from Online Source)

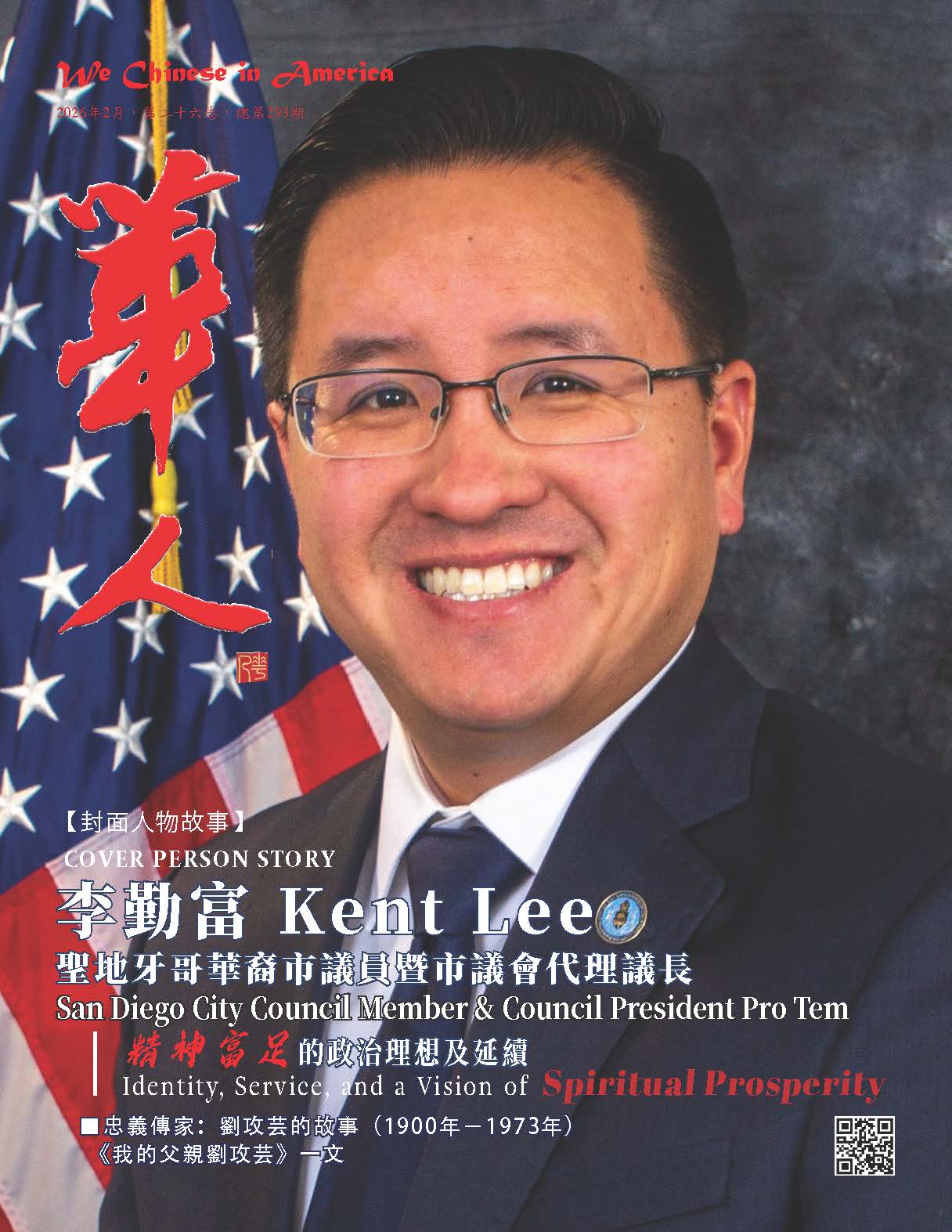

(Joint Account and Love for Children Image from Online Source)

A senior accountant said that if the child has never contributed any money to the account and withdraws more than $15,000, parents should take the initiative to use Form 709 to report the gift when filing tax returns or seek help from an accountant to fill out the form.

He pointed out that if both parents and children are citizens and open a joint account in the bank, assuming that the child has never put any money into it, even if the child takes the initiative to receive more than $15,000, it will be regarded as a gift from the parents. The new tax law increases estate and gift tax exemptions until 2025. In 2021, the combined personal estate and gift allowances will be $11.7 million, with the excess subject to tax. But at the same time, each person can donate $15,000 to different people each year, and the part exceeding $15,000 per person must be declared gift tax by the donor. Suppose this person gives his son $300,000 a year, of which $15,000 is tax-free, and if the excess is $285,000, the giver should fill in the form to declare the gift in that year, and it will be deducted from the comprehensive tax-free amount of inheritance and gifts that can be enjoyed in a lifetime. A 40% tax is payable if the usage amount exceeds $11.7 million.

(Joint Account Image from Online Source)

But foreigners don't have the $11.7 million tax-free allowance, so opening a bank account in the U.S. as a foreigner will result in a higher gift tax. For example. If the mother is a foreigner and the son is an American, the foreigner will have the same gift tax allowance of $15,000 per year. However, if the mother and son have a joint account, and the son has not put any money, but withdraws more than $15,000, or the mother transfers more than $15,000 to the son, the excess will be taxed at 40% immediately. The combined inheritance and gift tax exemption for natives amounted to $11.7 million.

The foreigner's inheritance in the United States is only $60,000 tax-free. Therefore, when a family involves multiple nationalities, special attention should be paid to such operations as gifts and transfers to avoid high taxes.

(Source: Compiled from Online Information)

This website has a free subscription function, please enter your email address and name (any nickname) in the upper right corner of the page. After subscribing, you can receive timely updates of the website. I hope that new and old readers will actively subscribe, so that we have the opportunity to provide you with better services

Please click: Home (wechineseus.com) for more news and content on this website

Follow The Chinese Media's Twitter account: https://twitter.com/wechineseinus

Follow The Chinese Media's Facebook account: https://www.facebook.com/wechineseinamerica/