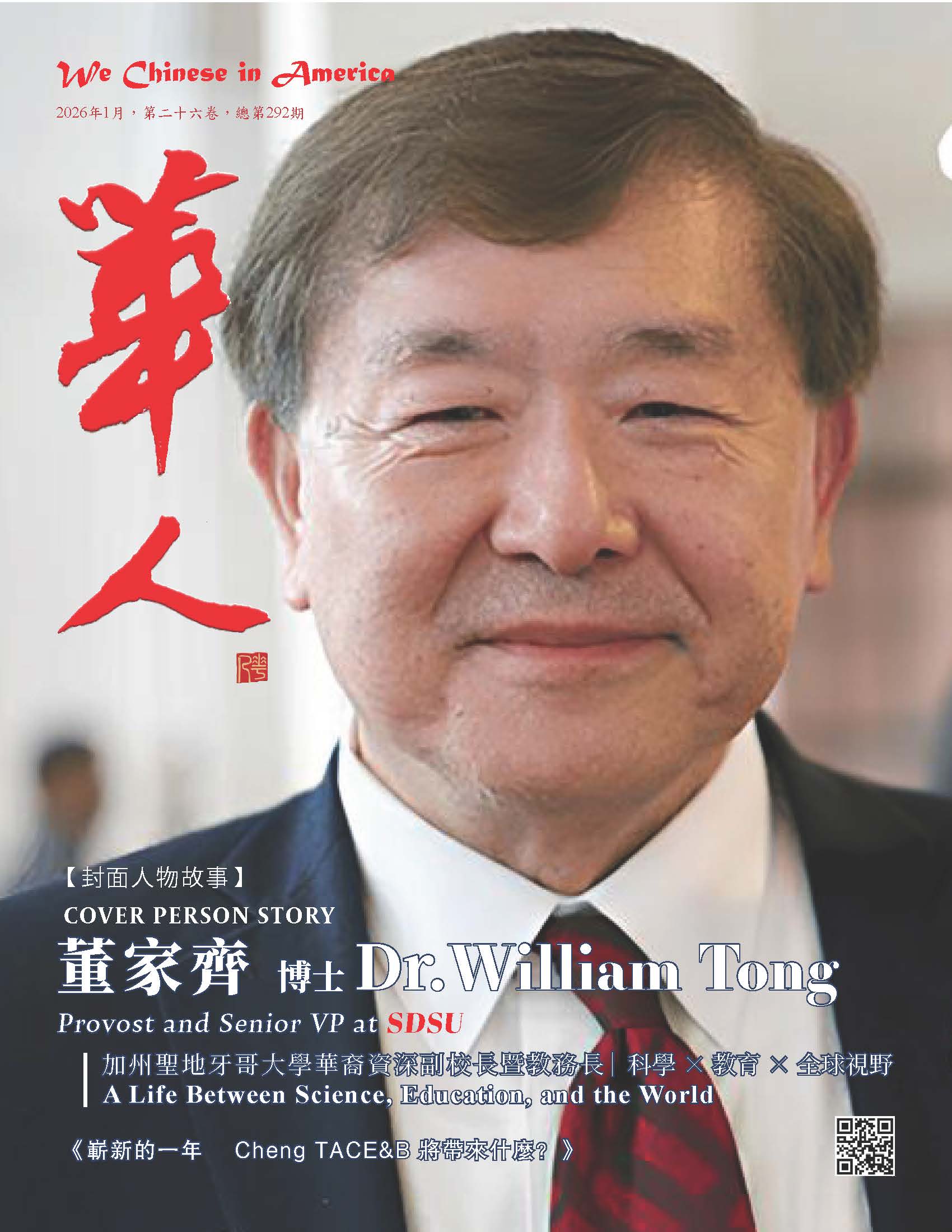

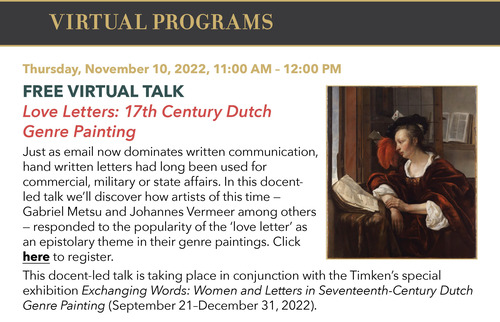

【《We Chinese in America》Media Editor Tang Zhao, November 7, 2022】Highlights of activities at Timken Museum of Art

(Source: Timken Museum)

This website has a free subscription function, please enter your email address and name (any nickname) in the upper right corner of the page. After subscribing, you can receive timely updates of the website. I hope that new and old readers will actively subscribe, so that we have the opportunity to provide you with better services

Please click: Home (wechineseus.com) for more news and content on this website

Follow The Chinese Media's Twitter account: https://twitter.com/wechineseinus

Follow The Chinese Media's Facebook account: https://www.facebook.com/wechineseinamerica/

【《We Chinese in America》Media Editor Tang Zhao, November 6, 2022】As an ongoing effort to enhance our valuable service to We Chinese in America website readers, We Chinese in America website posts English and Chinese versions of “IRS News Release” , “IRS Fact Sheets”, and “tax tips” directly received from IRS Media Relations Office in Washington, D.C.. We are pleased to take on this important role partnering with IRS to better inform the public.

IRS Independent Office of Appeals’ priorities for 2023 focus on taxpayer service

IR-2022-195, Nov. 4, 2022

WASHINGTON – Today, the IRS Independent Office of Appeals released its focus guide for fiscal year 2023. Appeals is taking important steps to expand communications with external stakeholders and to improve taxpayer access to Appeals. Promoting transparency and taxpayer access helps Appeals fulfill its mission to resolve tax disputes in a fair and impartial manner without the need for litigation.

The focus guide outlines the taxpayer service initiatives you can expect over the coming year, including:

- Increasing stakeholder outreach – including to historically marginalized and limited English proficient communities – about the appeals process

- Improving access to in-person and video conferences and revising letters and notices to ensure taxpayers understand that it is generally their choice how to meet with Appeals

- Leveraging technology to improve how Appeals works and manages its cases

- Continuing the Practitioner Perspectives series in which tax practitioners share insights and feedback with Appeals employees. Recordings of prior panel discussions on Collection Appeals and Examination Appeals are available

- Developing training for Appeals employees on enhancing customer engagement

“We are excited to share Appeals’ 2023 priorities,” said Andy Keyso, Chief of Appeals. “We will keep doing all we can to promote a positive experience for taxpayers and practitioners, while building upon our past accomplishments and applying lessons we learned from the challenges posed by COVID-19.”

A key success in 2022 is how Appeals addressed a significant increase in cases referred for settlement after the taxpayer filed a petition in the United States Tax Court. Many of these cases involved taxpayers without legal representation and resulted from communications challenges and difficulties in obtaining and sharing documents during the pandemic.

To avoid further delays, Appeals prioritized these docketed cases and dedicated additional resources to promptly resolve them. Appeals shared guidelines for how employees would streamline their approach to these cases with the public in April 2022. Under these guidelines, Appeals attempted to reach affected taxpayers by telephone shortly after receiving the cases. In addition, Appeals considered specific-dollar settlements, expedited tax computation, and streamlined internal documentation of proposed settlements. As always, Appeals Officers applied their professional judgment, including to accept oral testimony where appropriate, to settle the cases efficiently.

Using this approach, Appeals resolved all 7,500 docketed cases pending when the initiative began. To achieve permanent improvements to the taxpayer experience, the IRS is working to increase the number of cases resolved at the earliest stage possible—before a dispute arises.

“Ensuring that taxpayers and practitioners are satisfied with the appeals process is an ongoing goal for us,” said Shahid Babar, Acting Deputy Chief of Appeals. “The 2023 focus guide is a way to share with the public and with employees our ideas for continually improving how Appeals resolves tax disputes.”

Source: IRS News Release

Internal Resource Service

Media Relation Office

Washington, D. C

Media Contact: 202 317 4000

Public Contact: 800 829 1040

This website has a free subscription function, please enter your email address and name (any nickname) in the upper right corner of the page. After subscribing, you can receive timely updates of the website. I hope that new and old readers will actively subscribe, so that we have the opportunity to provide you with better services

Please click: Home (wechineseus.com) for more news and content on this website

Follow The Chinese Media's Twitter account: https://twitter.com/wechineseinus

Follow The Chinese Media's Facebook account: https://www.facebook.com/wechineseinamerica/

【《We Chinese in America》Media Editor Tang Zhao, November4, 2022】Saturday’s crush disaster in Seoul, which killed 154 people including two Japanese, has surely left many people in Japan wondering: just how safe are crowds in Japan? (Policemen stand guard on Sunday at the scene where a crush during Halloween festivities killed and injured many people in Seoul’s popular Itaewon district. Photo Credit: YONHAP / VIA REUTERS)

The police and government significantly stepped up crowd control measures in the wake of a pedestrian crush after a fireworks show in 2001 in Akashi, Hyogo Prefecture, which left 11 people dead and 247 injured, experts say. That disaster — considered by police to be a “disgrace” — led to the creation of a variety of police manuals on congestion control, and has made it standard practice for organizers of major events such as fireworks festivals and sports games to prepare detailed security plans and consult with local police beforehand.

But spontaneous large-scale gatherings for which there are no clear organizers responsible for crowd safety — such as with Saturday’s Halloween celebrations in the South Korean capital’s Itaewon district — are harder to control, and Japan isn’t immune from the risk of deadly crushes, experts say.

Katsuhiro Nishinari, a professor at the University of Tokyo’s Research Center for Advanced Science and Technology and a crowd management expert, said most measures should be in place before an event actually takes place. He added that, based on media reports, the crush in Itaewon was likely exacerbated by an insufficient police presence at the site.

I read in media reports that the narrow road was packed and there was no escape path on either side,” Nishinari said. “There’s a limit to how many people can cram into such a space.

“I think the accident may have been avoided had police officers controlled people’s movement at both ends of the alley, nudging people to move along and alerting them to how crowded the area was.”

Nishinari, who has studied 500 crowd disasters worldwide from over the past century, said Saturday’s Halloween crush resembles an incident in March 2010 that took place in Tokyo’s Harajuku district when a rumor of celebrity sightings set off a crowd surge on the similarly narrow Takeshita Street, causing some people to fall on top of each other. No one was killed in that incident, but four teenage girls were taken to the hospital after being stepped on by others or starting to hyperventilate, according to news reports from the time.

Mob psychology also comes into play. In 2002, a year after the deadly crush in Akashi, Hyogo Prefectural Police released a 120-page manual on crowd policing. It defines a crowd as a cluster of individuals whose age, gender and ideological backgrounds vary and who are not united by a single organization or a shared goal.

Such groups can be easily influenced by a groundless rumor or joke, and they also easily become excited and emotional, the manual says. In addition, individuals are more likely to resort to violent behavior when they become worried about a possible accident, it says.

The manual urges event organizers to calculate the expected crowd density beforehand, factoring in differences in clothing depending on the season.

Nishinari, who was involved in crowd management planning for the Tokyo Olympics, says congestion starts when there are more than two people in a 1 square-meter space.

A packed train — a common sight in Tokyo — has about six people in that space, but it rarely causes panic because people hardly move inside, he said.

“But if the number gets close to 10, an accident could happen at any time (even in a still crowd),” he said. Crowd density at Saturday’s scene was likely higher than that, he said.

So what should each of us do to avoid injury if we end up in an extremely congested space?

Nishinari said that if there’s no side route offering an escape, there’s not much people can do except to lift themselves up from the crowd by hanging onto a pole or climbing a wall, as suffocation is a major cause of death in such situations.

“You need to make sure you have an escape route at all times,” he said.

【《We Chinese in America》Media Editor Tang Zhao, November 5, 2022】he COVID-19 virus continues to circulate in San Diego County and all people are urged to be vaccinated and receive the updated booster. Information on the virus and vaccine is available at this link.(Photo credit: County of San Diego Communications Office).

Following is this week’s COVID-19 update from the County Health and Human Services Agency with data through October 29, 2022.

Vaccination Progress:

- More than 2.68 million or 80.3% of San Diegans received the primary series of one of the approved COVID-19 vaccines.

- Boosters administered: 1,485,461 or 59.6% of 2,490,433 eligible San Diegans.

- More vaccination information can be found at coronavirus-sd.com/vaccine.

Deaths:

- Eight additional deaths were reported since the last report on Oct. 27, 2022. The region’s total is 5,532.

- Of the eight additional deaths, four were women and four were men. They died between Oct. 12, 2022 and Oct. 21, 2022.

- Four of the people who died were 80 years or older, two were in their 70s and two were in their 60s.

- Five received at least the primary series of the vaccine and three had not.

- All had underlying medical conditions.

Cases, Case Rates and Testing:

- 1,702 COVID-19 cases were reported to the County in the past seven days (Oct. 25 to Oct. 31, 2022). The region’s total is now 931,279.

- The 1,702 cases reported in the past week were slightly higher compared to the 1,569 infections identified the previous week (Oct. 18 to Oct. 24, 2022).

- 5,650 tests were reported to the County on Oct. 29, and the percentage of new positive cases was 4.2% (Data through Oct. 29).

- The 14-day rolling percentage of positive cases, among tests reported through Oct. 29, is 3.7%.

(Source: County of San Diego Communications Office)

This website has a free subscription function, please enter your email address and name (any nickname) in the upper right corner of the page. After subscribing, you can receive timely updates of the website. I hope that new and old readers will actively subscribe, so that we have the opportunity to provide you with better services

Please click: Home (wechineseus.com) for more news and content on this website

Follow The Chinese Media's Twitter account: https://twitter.com/wechineseinus

Follow The Chinese Media's Facebook account: https://www.facebook.com/wechineseinamerica/

【《We Chinese in America》Media Editor Tang Zhao, November 3, 2022】Per he San Diego County Health and Human Services Agency (HHSA) is working in close collaboration with officials at San Diego Unified School District (SDUSD) and Sweetwater Union School District (SUHSD) to notify people who were possibly exposed to tuberculosis (TB) under separate circumstances at two different area high schools.(Photo credit: County of San Diego Communications Office)

SDUSD, SUHSD, and HHSA have notified individuals who have a higher risk of exposure to TB, and are arranging no-cost TB screening for those who are at increased risk of infection. While students and staff with increased risk for exposure have been identified, other students and staff may also have been exposed. The period of potential exposures are as follows:

- April 2, 2022 to Sept. 16, 2022 at Montgomery High School

- June 17, 2022 to July 10, 2022 at Mission Bay High School

Tuberculosis is an airborne disease that is transmitted from person to person through inhalation of the bacteria from the air. Chances of infection are higher for people with frequent and prolonged indoor exposure to a person who is sick with TB.

“Symptoms of active tuberculosis most commonly include persistent cough, fever, night sweats and unexplained weight loss,” said County Public Health Officer Dr. Wilma J. Wooten, M.D., M.P.H. “Most people who become infected after exposure to tuberculosis do not get sick right away. Some who become infected with TB will become ill at some point in the future, sometimes even years later. Blood tests and skin tests are effective to determine whether someone has been infected.”

Treatments are available that are effective in preventing people infected with tuberculosis from getting sick and in curing people who are sick. It is especially important for individuals with symptoms of TB and those who are immune-compromised to see their medical provider to rule-out an active case and to discuss treatment.

Individuals who would like more information on this potential exposure should call the San Diego County TB Control Program at (619) 692-8621.

The number of annual tuberculosis cases in San Diego County has decreased since the early 1990s and has stabilized in recent years. There were 201 cases reported in 2021. Through September, 126 cases have been reported to date in 2022.

(Source: County of San Diego Communications Office)

(Photo credit: County of San Diego Communications Office)

This website has a free subscription function, please enter your email address and name (any nickname) in the upper right corner of the page. After subscribing, you can receive timely updates of the website. I hope that new and old readers will actively subscribe, so that we have the opportunity to provide you with better services

Please click: Home (wechineseus.com) for more news and content on this website

Follow The Chinese Media's Twitter account: https://twitter.com/wechineseinus

Follow The Chinese Media's Facebook account: https://www.facebook.com/wechineseinamerica/