Omicron has led to a new wave of epidemics around the world. On the 10th, the number of Omicron hospitalizations in the United States once again exceeded the 140,000 mark, and it is more likely to surpass the record set at the peak of the epidemic last year soon. (Reuters)

(We Chinese in America Media Editor Tang Zhao, January 11, 2022) The Omicron variant virus has caused the global epidemic to heat up rapidly. According to Reuters statistics, the United States reported at least 1.35 million new diagnoses on the 10th (Monday), only lower than the record set during the peak of the epidemic on January 14 last year. The number of hospitalizations in France rose to 22,749 on the same day, the largest increase since April last year.

The number of Omicron hospitalizations in the United States once again exceeded the 140,000 mark on the 10th and is more likely to surpass the record set at the peak of the epidemic last year in the near future. Disease modelers predict that the number of hospitalizations may peak later this month, when the total number of hospitalizations will be falls between 275,000 and 300,0 00 people.

In addition to the surge in confirmed and hospitalized cases, the average number of deaths in a single day in the United States has also increased from 1,400 in recent days to 1,700. Meta Platforms, the parent company of Facebook, announced that it would postpone the reopening of its U.S. offices from the 31st of this month to March 28th, and required employees returning to work to receive booster vaccines. As the Omicron outbreak heats up, many companies are delaying their plans to return to the office.

The number of hospitalizations in France rose by 767 to 22,749 on the 10th, the largest increase since April last year. In addition, Polish Minister of Health Nizeski announced on the 11th that the number of deaths from the epidemic in Poland exceeded 100,000.

Employees who insist on not taking the vaccine are now being treated more and more severely by their employers. In the UK, if Ikea employees have not been vaccinated and are unable to go to work due to exposure to confirmed cases, Ikea will deduct their salary; however, employees who take sick leave for themselves are still paid according to sick leave.

(Source: World Journal)

Canada's Chief Health Officer Theresa Tam called on the public to abandon cloth masks, saying that N95 masks can provide better protection. (Associated Press)

(We Chinese in America Media Editor Tang Zhao, January 10, 2022) The Omicron variant virus has caused a new wave of epidemics around the world. Because the virus is more transmissible, Canada's Chief Health Officer Theresa Tam has called on people to abandon cloth masks, saying that N95 masks can provide better protection.

Theresa Tam said, "Even though Omicron is milder than the previous variant virus, its spread is so fast that even if only a small number of people in the hospital are infected, it will overwhelm my medical system." Tam said, "It's time to give up Cloth masks, they won't protect you from Omicron," adding that "medical masks are better at filtering viruses, although even 3-ply surgical masks may not be enough, N95 masks are more suitable".

In addition to Theresa Tam, after the outbreak in the United States has been heating up recently, former White House official Rick Bright also tweeted that officials including chief epidemic prevention expert Anthony Fauci, director of disease control Rochelle Walensky and other officials have changed their minds started wearing an N95 or KN95 mask. Bright urged the public " we should pay attention and emulate them by wearing high-quality N95 or KN95 masks to provide ourselves with the same level of protection as them".

In this regard, Leana Wen, an emergency physician and public health professor at George Washington University, said: "In the face of this airborne contagious variant virus, at least three layers of surgical masks should be worn, but for many people , This disposable mask is not suitable for the face shape, so you can wear an additional layer of cloth mask outside to improve the fit", but still emphasizes that "everyone should really use N95 or KN95 masks."

(Source: World Journal)

Maryland began distributing home test kits. The picture shows Montgomery County Library staff and volunteers preparing to distribute the kits. (European News Agency)

We Chinese in America Media Editor Tang Zhao, January 10, 2022) The Biden administration announced on the 10th that starting the 15th, private health insurance companies must provide each insured consumer with up to eight sets of new coronavirus home testing kits per month. The Associated Press reported and analyzed that the epidemic has heated up and frustrated the public, and the Biden administration's strategy aims to reduce costs and make virus testing easier.

"This is part of our overall strategy to provide free and easy-to-use home testing kits as soon as possible," Health Minister Xavier Becerra said in a statement. The goal is to expand people's ability to get free testing when they need it."

According to the new regulations of the Biden administration, the public can purchase a home virus testing kit free through private insurance or provide a receipt for purchasing a virus testing kit to apply for reimbursement from the insurance company, as long as the number does not exceed the monthly limit. Taking a family of four as an example, a maximum of 32 virus testing kits can be applied for reimbursement each month.

Nucleic acid testing (PCR) and rapid screening prescribed and conducted by medical institutions will be borne by insurance companies with no upper limit.

During the holidays, many people went out to reunite with their relatives. As the Omicron variant virus spreads rapidly, there was a serious shortage of available home virus rapid screening test kits, and President Biden was criticized by public opinion. The Associated Press reported that the Biden administration is now trying to make it easier for home testing teams to get the virus by increasing supply and lowering prices.

The report pointed out that by the end of this month, the federal government will also launch a new website and start sending 500 million home virus test kits by email; in the areas where the number of confirmed cases is currently increasing the fastest, the federal government will also accelerate the pace of establishing a COVID 19 quick screening emergency testing station.

The Associated Press analyzed that virus testing kits, which are borne by insurance companies, will save people a considerable amount of money. The federal government hopes that when home virus testing kits become more common, the speed of virus transmission will be slowed down. The goal is to have children return to school as soon as possible, and to allow the public to gather safely.

White House spokeswoman Jen Psaki said at a press briefing on the 10th that the free virus testing kits provided by the federal government to the public will be sent to people’s homes in the next few weeks.

She said that according to the contract between the federal government and the contractor, the delivery time of the virus testing team must be fast and accurate. "The first batch can be sent as soon as next week."

Psaki said the contractors will be sending out all the virus test kits in the next two weeks, and people will be able to book follow-up kits online by the end of the month; A telephone service line will be established.”

(Source: World Journal)

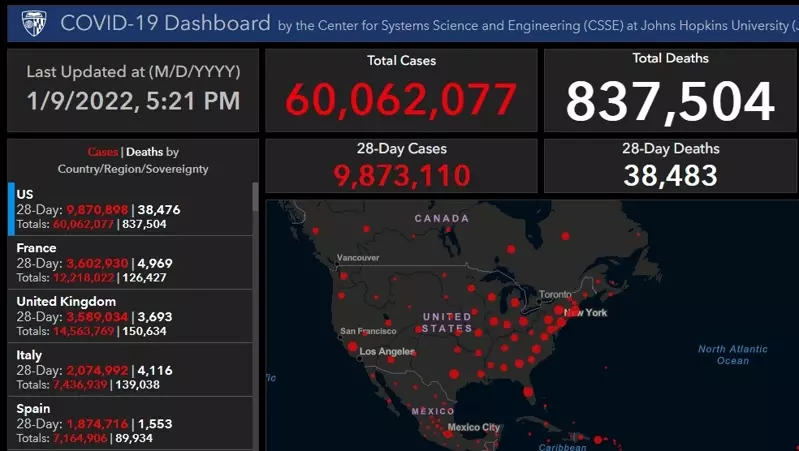

According to the latest statistics on the COVID 19 epidemic released by Johns Hopkins University on the 9th (Sunday), the cumulative number of confirmed cases in the United States has exceeded 60 million. (Photo is from Johns Hopkins University website)

(We Chinese in America Media Editor Tang Zhao, January 9, 2022) According to the latest statistics on the COVID 19 epidemic released by Johns Hopkins University at 5:21 p.m. Eastern Time on the 9th (Sunday), the cumulative number of confirmed cases in the United States has exceeded 60 million, reaching 60,062,077. The death toll was 837,504. There were 9,873,110 new confirmed cases in the last 28 days and 38,476 deaths.

(Source: World Journal)